Bradda Head Lithium Ltd Announces Unaudited Interim Financial Statements

ACCESS Newswire

27 Jan 2023, 16:14 GMT+10

Unaudited Condensed Consolidated Interim Financial Statements

For the nine-month period ended November 30, 2022

Notice of No Auditor Review

BRITISH VIRGIN ISLANDS / ACCESSWIRE / January 27, 2023 / These unaudited condensed consolidated interim financial statements of Bradda Head Lithium Limited (the 'Company') have not been reviewed by the auditors of the Company.

Condensed Interim Consolidated Statement of Comprehensive Income

for the period ended November 30, 2022

The accompanying notes are an integral part of these consolidated interim financial statements.

Condensed Interim Consolidated Statement of Financial Position

as at November 30, 2022

The accompanying notes are an integral part of these consolidated interim financial statements.

These condensed interim consolidated financial statements were approved by the Board of Directors on January 27, 2023 and were signed on their behalf by:

Denham Eke

Director

Condensed Interim Consolidated Statement of Changes in Equity

for the period ended November 30, 2022

The accompanying notes are an integral part of these consolidated interim financial statements.

Condensed Interim Consolidated Statement of Changes in Equity

for the period ended November 30, 2022 (continued)

The accompanying notes are an integral part of these consolidated interim financial statements.

Condensed Interim Consolidated Statement of Cash Flows

for the period ended November 30, 2022

The accompanying notes are an integral part of these consolidated interim financial statements.

1 Reporting Entity and basis of preparation

Bradda Head Lithium Limited (the 'Company') is a company domiciled in the British Virgin Islands. The address of the Company's registered office is Craigmuir Chambers, Road Town, Tortola, British Virgin Islands. The Company and its subsidiaries together are referred to as the 'Group'.

The Company is a lithium exploration Group focused on developing its projects in the USA.

These interim financial statements have been prepared in accordance with IAS 34 Interim Financial Reporting and should be read in conjunction with the last annual consolidated financial statements as at and for the year ended February 28, 2022 ('last annual financial statements'). They do not include all of the information required for a complete set of IFRS financial statements. However, selected explanatory notes are included to explain events and transactions that are significant to an understanding of the changes in the Group's financial position and performance since the last annual financial statements.

The financial information in this report has been prepared in accordance with the Company's accounting policies and in consistency with the last annual financial statements. Full details of the accounting policies adopted by the Company are contained in the financial statements included in the Company's annual report for the year ended February 28, 2022, which is available on the Group's website: www.braddheadltd.com, and on SEDAR at www.sedar.com. These unaudited condensed consolidated interim financial statements should be read in conjunction with the audited Consolidated Financial Statements for the year ended February 28, 2022.

2 General and administrative

The Group's general and administrative expenses include the following:

3 Deferred mine exploration costs

The schedule below details the exploration costs capitalised to date:

The recoverability of the carrying amounts of exploration and evaluation assets is dependent on the successful development and commercial exploitation or sale of the respective area of interest, as well as maintaining the assets in good standing. The Group assessed the DMEC relating to areas for which licenses and permits are held, for impairment as at November 30, 2022. The Board concluded that no facts and circumstances have been identified which suggest the recoverable amount of these assets would not exceed the carrying amount and, as such, no impairment was recognised during the period.

During the year ended February 28, 2022, an impairment charge of US$ Nil was recognised.

4 Exploration permits and licences

The schedule below details the exploration permit and licence costs capitalised to date:

The Group assessed the carrying amount of the licences and permits held for impairment as at November 30, 2022. The Board concluded that no facts and circumstances have been identified which suggest the recoverable amount of these assets would not exceed the carrying amount and, as such, no impairment was recognised during the period.

During the year ended February 28, 2022, an impairment charge of US$ 230,230 was recognised as a result of project licences and permits that were not renewed.

5 Investment in subsidiary undertakings

As at November 30, 2022 and February 28, 2022, the Group had the following subsidiaries:

* Held directly by the Company. All other holdings are indirectly held through Bradda Head Limited

The condensed interim consolidated financial statements include the results of the subsidiaries for the full interim period from March 1, 2022 to November 30, 2022, and up to the date that control ceases.

6 Trade and other receivables and advances and deposits

Non-current

Current

7 Trade and other payables

8 Plant and equipment

8 Plant and equipment (continued)

9 Share premium

Authorised

The Company is authorised to issue an unlimited number of nil par value shares of a single class.

10 Equity settled share based payments

The cost of equity settled transactions with certain Directors of the Company and other participants ('Participants') is measured by reference to the fair value at the date on which they are granted. The fair value is determined based on the Black-Scholes option pricing model.

During the nine-month period ended November 30, 2022, outstanding fees due to directors totaling US$ Nil were settled by the issue of shares (28 February 2022: US$Nil)

Options and warrants

The total number of share options and warrants in issue as at the period end is set out below.

10 Equity settled share based payments (continued)

The amount expensed in the income statement has been calculated by reference to the fair value at the grant date of the equity instrument and the estimated number of equity instruments to vest after the vesting period.

The inputs used in the measurement of the fair values at grant date of the equity-settled share-based payment plans issued during the period are as follows:

April 2022 options

Terms of the issued options are as follows:

- 9,200,000 options have been granted and are subject to the three independent vesting conditions for 1/3 of the entitlement, relating to the successful fund raising in respect of the Group's operational budget, commencement of a drilling program in respect of the San Domingo project and resolution of certain Wickieup project title claims. All un-exercised options expire after a period of 5 years from grant date. It is assumed that options are exercised within 5 years from date of grant. The applied volatility is based on historical volatility.

April 2022 supplier warrants

Terms of the issued warrants are as follows:

- As part of the fundraise completed during April 2022, certain service providers of the Company received warrants for services rendered. As a result, 3,244,331 warrants have been issued. All un-exercised warrants expire after a period of 2 years from grant date. It is assumed that warrants are exercised within 2 years from date of grant. The applied volatility is based on historical volatility.

11 Warrants

The cost of equity warrants granted during the period are measured by reference to the fair value at the date on which they are granted. The fair value is determined based on the Black-Scholes option pricing model.

During the nine-month period ended November 30, 2022, the Company awarded warrants to investors who participated in the fundraise completed during April 2022.

The total number of warrants in issue as at the period end is set out below.

The fair value applied to the shareholder warrants has been classified as a financial liability. At period end, the warrant liability has been re-measured to fair value, with a corresponding entry to profit and loss of US$ 3,711,264 (period ended November 30, 2021: Nil) within Warrant Fair Value Re-Measurement.

Reconciliation of warrant liability fair value:

11 Warrants (continued)

April 2022 shareholder warrants

As part of the fundraise completed during April 2022, all participating shareholders received a warrant on 1:1 basis for shares acquired. As a result, 73,195,560 warrants have been issued. All un-exercised warrants expire after a period of 2 years from grant date. It is assumed that warrants are exercised within 2 years from date of grant. The applied volatility is based on historical volatility.

12 Basic and diluted loss per share

The calculation of basic profit per share of the Company is based on the loss for the period of US$ 3,074,862 (nine-month period to November 30, 2021: loss of US$ 2,052,489) and the weighted average number of shares of 379,122,544 (at November 30, 2021: 147,618,936) in issue during the period.

Diluted loss per share is calculated by adjusting the weighted average number of ordinary shares outstanding to assume conversion of all dilutive potential ordinary shares such as warrants and options. An adjustment for the dilutive effect of share options and warrants in the current period has not been reflected in the calculation of the diluted loss per share, as the effect would have been anti-dilutive, due the Company recognising a loss for the period.

13 Related party transactions and balances

Edgewater Associates Limited ('Edgewater')

During the nine-month period ended November 30, 2022, Directors' and Officers' insurance was obtained on an arms-length basis through Edgewater, which is a 100% subsidiary of Manx Financial Group ('MFG'). James Mellon and Denham Eke are Directors of both the Company and MFG.

During the period, the premium payable on the policy was US$ 49,318 (year ended February 28, 2022: US$ 44,303), of which US$ 32,122 was prepaid as at the period end (February 28, 2022: US$ 11,076).

14 Commitments and contingent liabilities

The Group has certain obligations to expend minimum amounts on exploration works on mining tenements in order to retain an interest in them, equating to approximately US$ 415,454 during the next 12 months. This includes annual fees in respect of licence renewals. These obligations may be varied from time to time, subject to approval and are expected to be filled in the normal course of exploration and development activities of the Company.

15 Events after the reporting date

On 21 December 2022, the Company awarded 500,000 ordinary share options each to Euan Jenkins and Alex Borrelli, independent non-executive directors of the Company.

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact [email protected] or visit www.rns.com.

SOURCE: Bradda Head Lithium Limited

View source version on accesswire.com:

https://www.accesswire.com/737037/Bradda-Head-Lithium-Ltd-Announces-Unaudited-Interim-Financial-Statements

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Canada Standard news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Canada Standard.

More InformationInternational

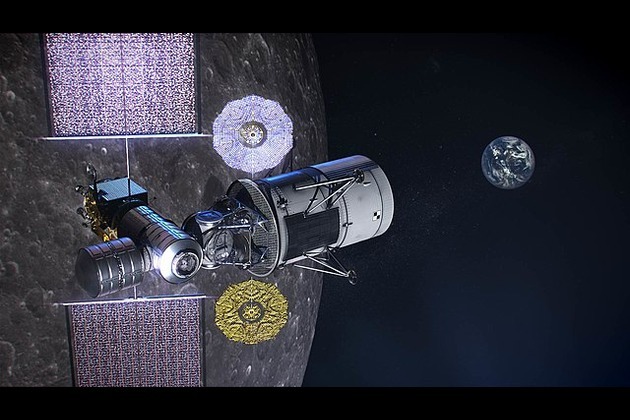

Sectionispace lander crashes on moon; Japan faces new lunar setback

TOKYO, Japan: Japan's hopes for a foothold in commercial lunar exploration suffered a second blow this week after Tokyo-based startup...

FSB claims Russian professors linked to British Council espionage

MOSCOW, Russia: Russia's principal security agency, the Federal Security Service (FSB), has accused British intelligence of using the...

Australian PM rejects US pressure to ease biosecurity rules

SYDNEY, Australia: Australia will not ease its strict biosecurity rules during trade talks with the United States, Prime Minister Anthony...

Flotilla ship prevented from reaching Gaza, passengers and crew detained

The Israeli Navy has intercepted a ship carrying humanitarian aid and a number of activists including Greta Thunberg, Rima Hassan,...

Japan’s 2024 birth rate drops below 700,000 for first time

TOKYO, Japan: Japan's demographic challenges intensified in 2024, with the number of births falling to another all-time low—underscoring...

China bureaucrat bottlenecks over rare earths ripple through industry

BEIJING, China: A little-known office inside China's Ministry of Commerce has become a powerful chokepoint in the global auto and tech...

Sports

SectionAl Ain defeat Auckland City ahead of FIFA Club World Cup

WASHINGTON, 10th June, 2025 (WAM) -- Al Ain FC defeated New Zealand's Auckland City by a single goal in a friendly match played as...

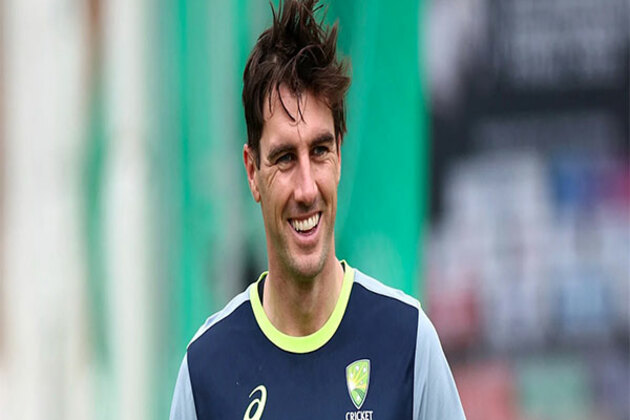

WTC final 2025: Aakash Chopra weighs in on Pat Cummins' impact

New Delhi [India], June 10 (ANI): As the ICC World Test Championship (WTC) final 2025 draws near, anticipation is building for the...

Rajeev Shukla lauds Dhoni's induction in ICC Hall of Fame, recalls "immense contribution" to cricket world

New Delhi [India], June 10 (ANI): Board of Control for Cricket in India (BCCI) vice president Rajeev Shukla has hailed former India...

(SP)SOUTH KOREA-SEOUL-FOOTBALL-FIFA WORLD CUP QUALIFIER-SOUTH KOREA VS KUWAIT

(250610) -- SEOUL, June 10, 2025 (Xinhua) -- Lee Han-beom (R) of South Korea shoots during the 2026 FIFA World Cup Asian Qualifiers...

(SP)CHINA-CHONGQING-FOOTBALL-FIFA WORLD CUP QUALIFIER-CHINA VS BAHRAIN-PRESS CONFERENCE (CN)

(250610) -- CHONGQING, June 10, 2025 (Xinhua) -- Head coach of China Branko Ivankovic (R) and player Wang Yudong of China attend a...

Hockey India announces 24-member Indian Junior Men's squad for 4 Nations Tournament in Germany

New Delhi [India], June 10 (ANI): Hockey India on Tuesday announced the Indian Junior Men's Hockey Team for the upcoming 4 Nations...